How Leading Companies Use Accounts Payable Automation to Stay Ahead

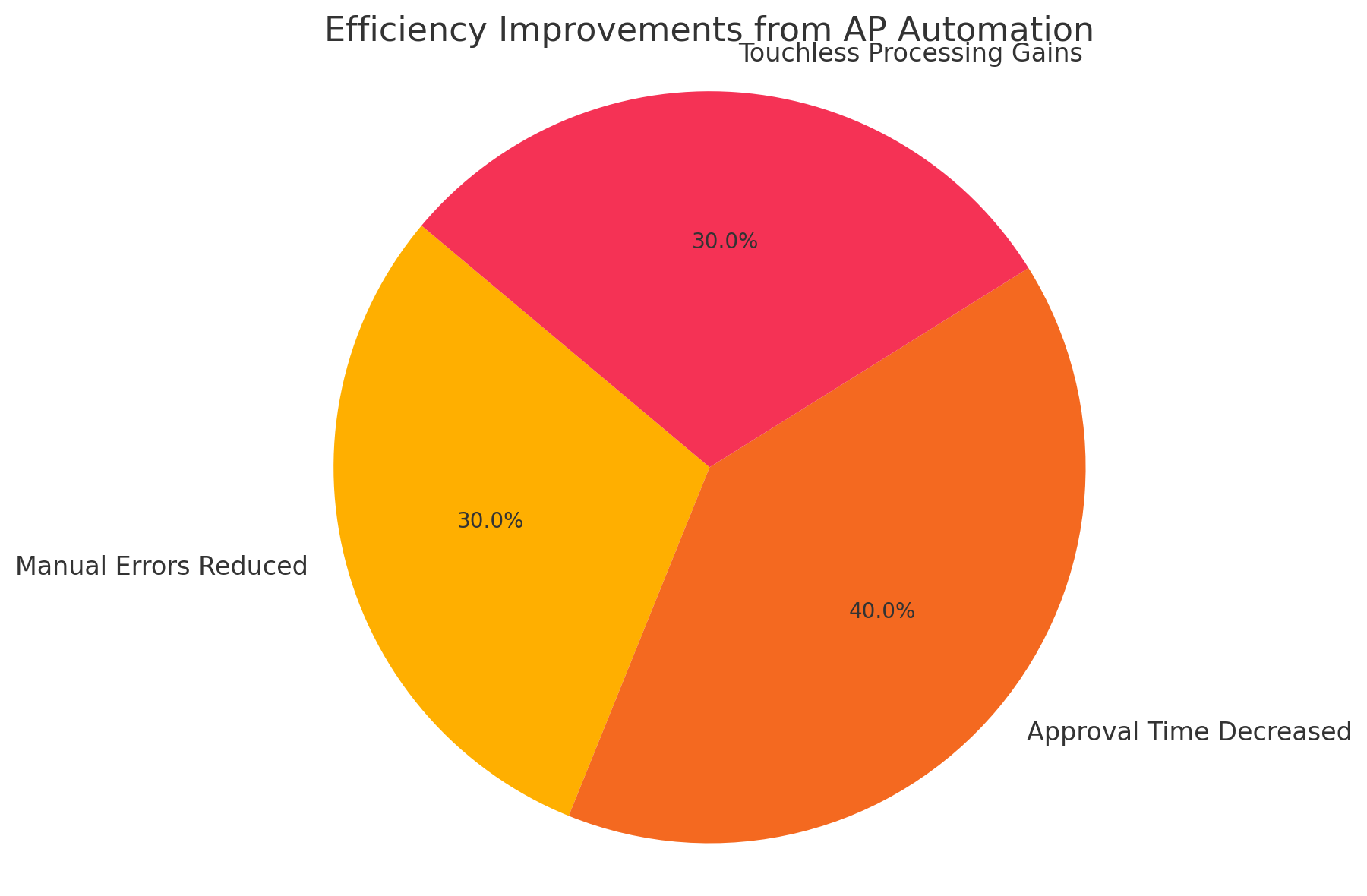

Accounts payable automation is the use of digital systems to streamline, manage, and optimize the process of receiving, processing, and paying supplier invoices. Rather than relying on manual data entry, spreadsheets, and paper checks, businesses implement automated tools that handle invoice scanning, approval workflows, and electronic payments. These solutions reduce human error, accelerate payment cycles, and enable better financial visibility.

The Traditional Accounts Payable Process

Before automation, companies managed payables using labor-intensive steps like manual invoice matching, data entry, and physical approvals. This process was not only time-consuming but also prone to costly errors and payment delays. Reconciliation required hours of backtracking, and companies faced frequent duplicate payments or lost invoices.

Evolution of AP Automation Technology

Initially, AP automation began with simple scanning tools and optical character recognition (OCR) systems. Over time, it evolved with the integration of AI, machine learning, and enterprise resource planning ERP systems. Today’s platforms offer touchless invoicing, predictive analytics, and real-time dashboards, giving CFOs critical insights into cash flow and vendor performance.

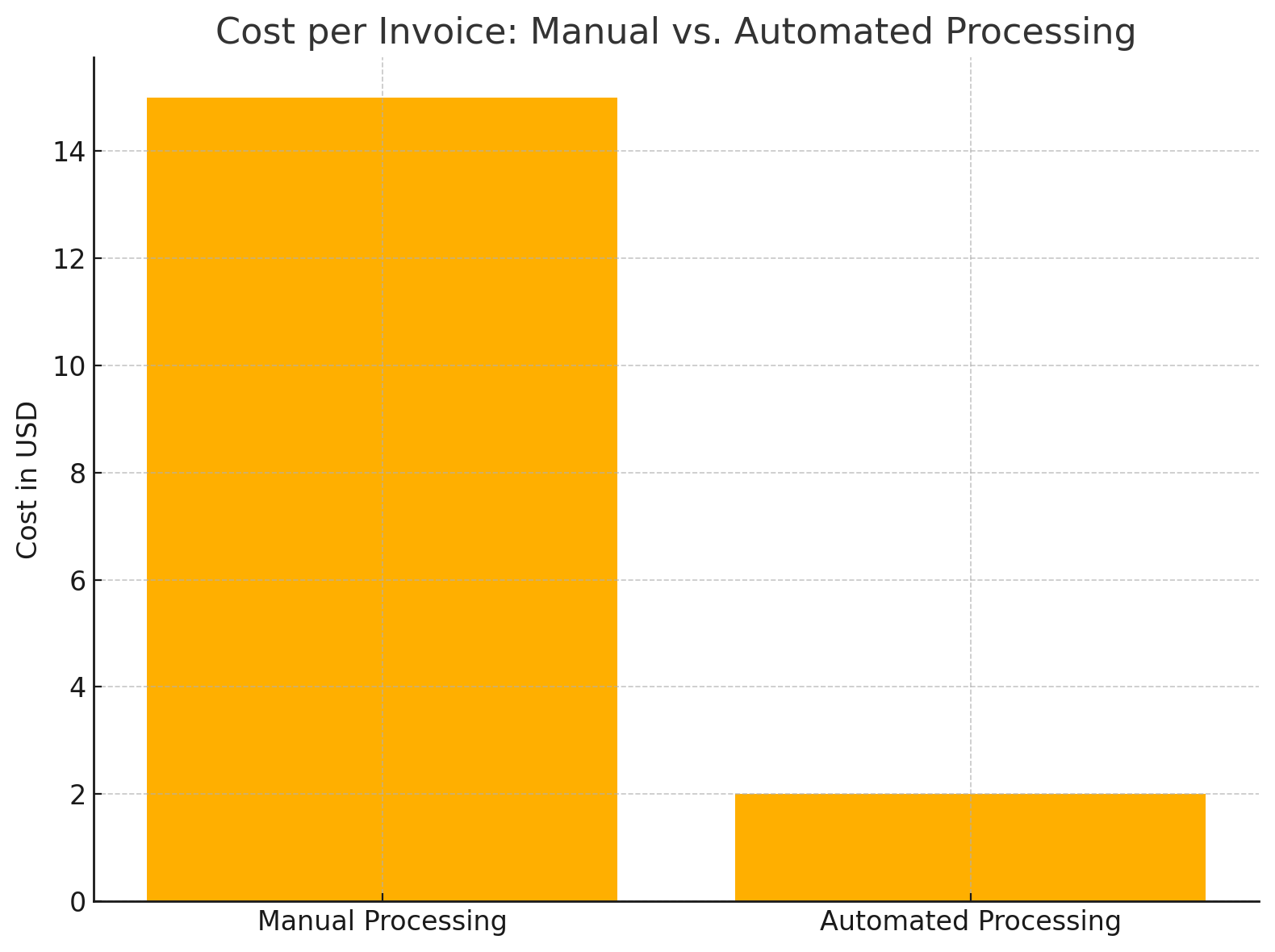

Cost Per Invoice: Manual Vs. Automated Processing

The cost per invoice can vary significantly between manual and automated processing. On average, manually processing an invoice can cost anywhere from $12 to $30 due to labor, time delays, paper handling, and error correction. In contrast, with accounts payable automation, the cost drops dramatically, often to as low as $1 to $5 per invoice. This reduction is primarily driven by the elimination of manual tasks, faster approval cycles, fewer errors, and improved data accuracy. Over time, these savings can add up to thousands or even millions of dollars for mid-sized and large organizations, making automation a strategic financial decision.

Why AP Automation is a Game Changer for Businesses

Cost Savings and Increased Efficiency

Automated AP systems significantly lower processing costs by reducing manual labor, eliminating paper use, and shortening invoice approval times. Where manual processing could cost up to $15 per invoice, automation can reduce it to under $2. Additionally, faster processing improves relationships with vendors through on-time or early payments, often unlocking discounts.

Real-Time Analytics and Financial Visibility

AP automation and blockchain provide CFOs and finance teams with up-to-the-minute data on payment statuses, outstanding invoices, and cash flow. These insights support more informed decision-making and enhance forecasting capabilities.

Compliance, Fraud Prevention, and Audit Readiness

Automation enforces business rules consistently and keeps an auditable trail of every action taken. This ensures better regulatory compliance, reduces the risk of internal fraud, and simplifies the audit process, making documentation retrieval instant.

Key Features of Effective AP Automation Systems

Integration with ERP Systems

Modern AP tools integrate directly with popular ERP systems like Oracle, SAP, and NetSuite. This ensures seamless data flow between departments and real-time updates across platforms.

AI and Machine Learning in AP

Machine learning algorithms help with invoice classification, vendor verification, and fraud detection. These systems continuously learn from past behavior, improving accuracy and reducing the need for manual intervention.

Cloud-Based and Mobile Capabilities

Cloud solutions offer flexibility, security, and accessibility, allowing finance teams to work from anywhere. Mobile apps empower managers to approve payments remotely, speeding up the entire process.

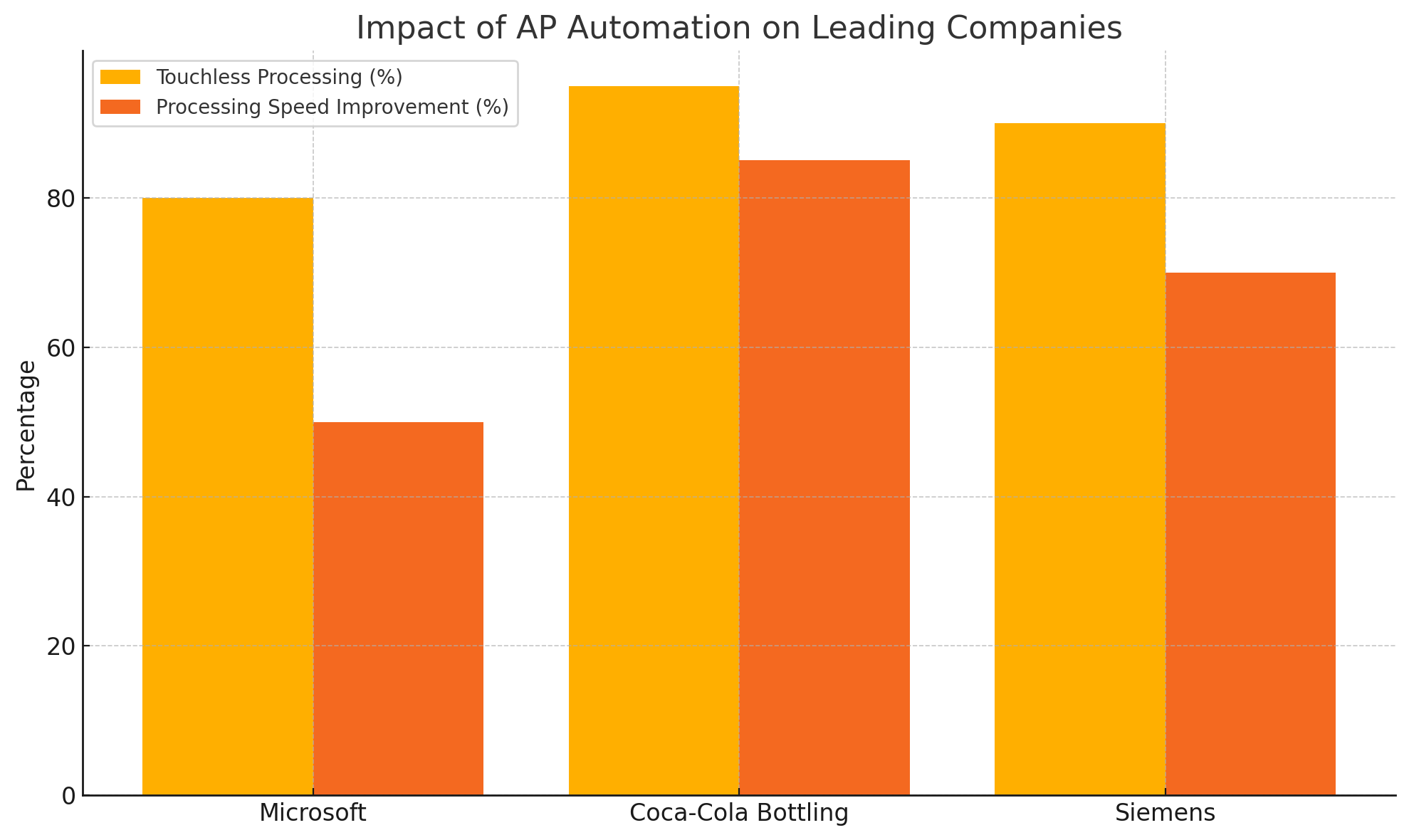

Impact Of AP Automation On Leading Companies

Case Study: How Microsoft Transformed Global Finance Operations

Microsoft, a global technology giant, faced increasing complexity in managing its accounts payable operations due to its massive supplier network and international presence. Before automation, the finance team grappled with inconsistent processes across regions, delayed payments, and challenges with global compliance.

To address these issues, Microsoft implemented an enterprise-wide AP automation solution integrated with its SAP ERP system. The company used tools such as Tradeshift and Basware to centralize invoice processing. Automation allowed Microsoft to standardize workflows, apply consistent business rules globally, and eliminate regional inefficiencies.

As a result, Microsoft achieved over 80% touchless invoice processing. Payment cycles were reduced by 50%, and the company realized significant savings through early payment discounts. Additionally, real-time dashboards provided CFOs with global visibility into spending and liabilities, aiding in financial strategy development.

Case Study: Coca-Cola Bottling’s Seamless Transition to Touchless Invoicing

Coca-Cola Bottling Company United, a major independent bottler in the U.S., faced challenges due to its reliance on paper-based invoicing and decentralized approval systems. This resulted in slow invoice turnaround times, duplicate payments, and poor supplier satisfaction.

To combat these issues, Coca-Cola Bottling implemented Esker’s AP automation platform. The rollout began with a phased implementation across their locations, prioritizing facilities with the highest invoice volumes. The system digitized invoice capture, automated approval routing, and integrated directly with their JD Edwards ERP.

Post-implementation, Coca-Cola achieved nearly 95% invoice processing efficiency, cutting approval times from several weeks to under three days. Suppliers benefited from better communication and faster payments, while the finance team enjoyed improved control, transparency, and data analytics.

Case Study: Siemens Modernizes AP for Global Scale

Siemens, one of the largest industrial manufacturing companies in the world, operates in more than 190 countries and handles millions of invoices annually. Its legacy AP systems were fragmented, leading to inconsistencies, high processing costs, and compliance risks.

Siemens partnered with Ariba and SAP S/4HANA to implement a unified AP automation platform tailored for global operations. The project focused on aligning all international finance teams under one digital workflow, enabling smart invoice matching, centralized processing, and AI-powered exception handling.

The impact was profound. Siemens saw a 70% improvement in invoice processing times and achieved a first-pass match rate of over 90%. The automation project also empowered Siemens to scale its operations without adding headcount, ultimately reducing costs while enhancing control and audit capabilities.

Common Challenges in AP Automation Projects

Despite the clear benefits, implementing accounts payable automation isn’t without hurdles. Many companies face issues related to internal resistance, technical incompatibilities, and the complexities of migrating large volumes of historical data.

Change Management and Employee Training

Transitioning from manual to automated systems often meets resistance from staff accustomed to traditional workflows. Without a solid change management strategy, the project can face delays or underperformance. Leading companies like Coca-Cola and Siemens tackled this by investing in comprehensive employee training programs and involving key stakeholders early in the process.

These sessions not only helped employees understand the value of automation but also empowered them to use the new systems effectively. Having “automation champions” within teams further smoothed the transition and ensured widespread adoption.

Data Migration and Legacy System Integration

Migrating data from legacy systems to modern automation platforms can be technically complex and risky. Compatibility issues, missing records, and data corruption are common challenges. Siemens dealt with these problems by running pilot programs in specific regions before rolling out the solution company-wide. They also worked closely with vendors to develop custom integrations for their ERP and finance systems, ensuring data integrity and smooth migration.

How to Choose the Right AP Automation Vendor

Selecting the right vendor is a critical step that determines the success of your automation project. It’s important to evaluate potential partners based on their experience, technology capabilities, customer support, and alignment with your business goals.

Questions to Ask and Features to Prioritize

When assessing vendors, leading companies ask strategic questions such as:

- Does the solution integrate seamlessly with our existing ERP?

- How secure is the platform, and what compliance standards does it meet?

- Can the system handle multi-currency and multi-language invoices?

- What kind of support and onboarding do you offer?

They also look for features like customizable workflows, AI-powered matching, real-time dashboards, and mobile access. Microsoft, for instance, chose a platform that offered advanced analytics and global scalability, ensuring that their global finance operations remained cohesive and controlled.

The Future of Accounts Payable Automation

AP automation continues to evolve, driven by advancements in AI, machine learning, and blockchain. These technologies are not just improving efficiency; they’re redefining the role of accounts payable in strategic decision-making.

AI-Driven Automation and Hyper-Automation

AI enables intelligent automation that goes beyond basic invoice processing. It can detect anomalies, suggest optimal payment strategies, and even forecast future liabilities. Hyper-automation, the integration of multiple advanced technologies, is the next frontier, aiming to automate every step of the AP lifecycle with minimal human intervention.

Companies like Siemens and Microsoft are already investing in these innovations to maintain their competitive edge. As AI capabilities grow, AP automation will become even more predictive, autonomous, and strategic.

FAQs

1. What is accounts payable automation?

Accounts payable automation refers to the use of technology to digitize and streamline invoice processing, approval workflows, and payment disbursement.

2. How does AP automation reduce costs?

It lowers processing costs by minimizing manual work, eliminating paper, reducing errors, and enabling early payment discounts.

3. Can AP automation integrate with any ERP system?

Most leading solutions integrate with major ERP platforms like SAP, Oracle, NetSuite, and Microsoft Dynamics, though some customization may be required.

4. What companies are successfully using AP automation?

Microsoft, Coca-Cola Bottling, and Siemens are examples of companies that have successfully implemented AP automation and achieved measurable results.

5. Is AP automation secure?

Yes, reputable AP platforms adhere to strict data security standards like GDPR and SOC 2 compliance and offer robust audit trails and user permissions.

6. What is the average ROI on AP automation?

Many companies report an ROI within 6-12 months, driven by cost savings, faster processing times, and improved cash flow management.

Conclusion

The stories of Microsoft, Coca-Cola Bottling, and Siemens reveal a common truth: companies that embrace accounts payable automation not only improve operational efficiency but also gain a strategic edge. Automation transforms accounts payable from a back-office function into a powerful tool for financial insight, supplier management, and competitive advantage.