How Does Accounting Software Impact Cash Flow?

Cash flow is the lifeblood of any business, no matter its size. Whether you’re just starting or running a well-established company, managing cash flow effectively is essential for success. So, how does accounting software impact cash flow? In this article, we’ll dive deep into the powerful ways accounting software can improve your cash flow management and help you make smarter financial decisions.

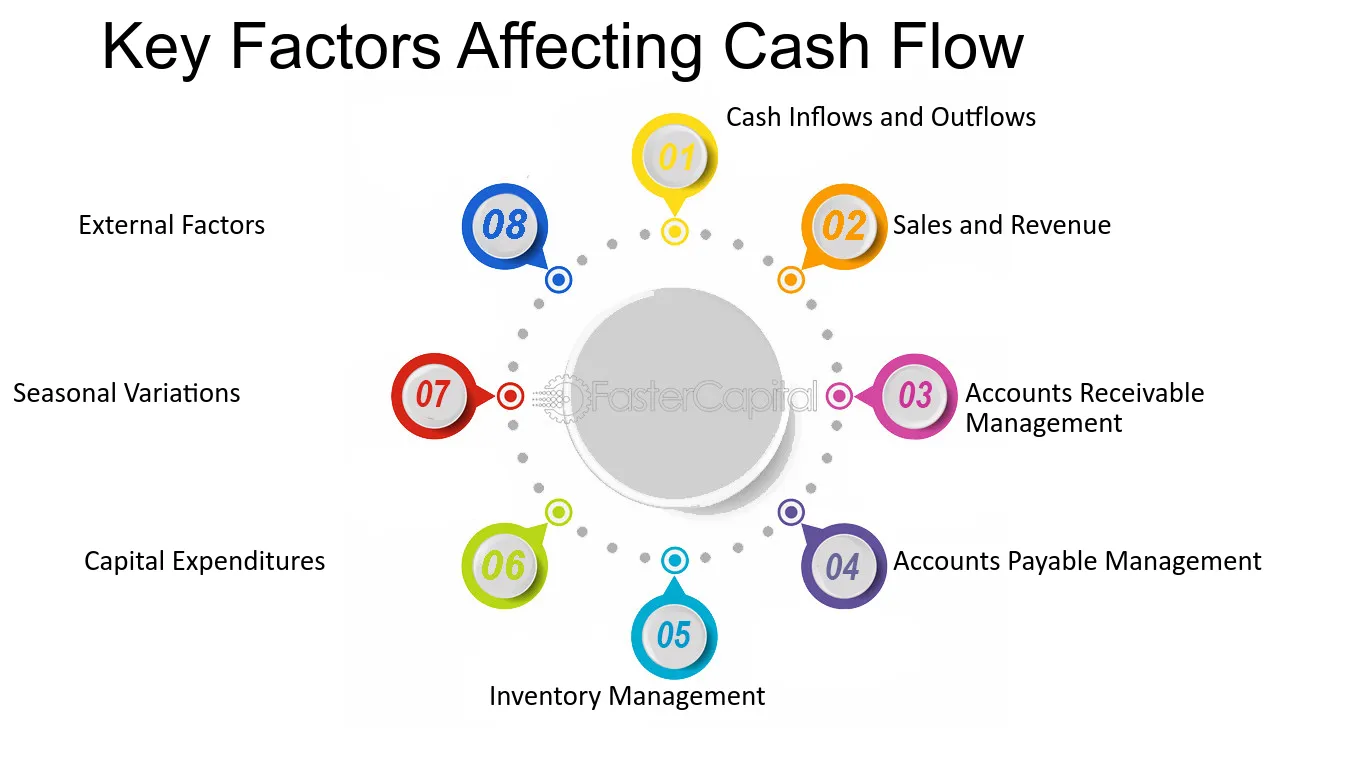

What is Cash Flow and Why Does it Matter?

Before we explore the role of accounting software, let’s make sure we’re clear on what cash flow is. Simply put, cash flow is the money that moves in and out of your business. It includes sales revenue, loans, and expenses. Positive cash flow means your business is generating more income than it’s spending, while negative cash flow can indicate financial struggles.

Good cash flow management is vital for covering operational expenses, paying employees, investing in growth, and avoiding potential financial crises. But how can you track all this without the right tools? Here’s where accounting software steps in.

How Does Accounting Software Impact Cash Flow?

Accounting software has the potential to streamline your financial processes, giving you clearer insights into your cash flow. By automating many of the tasks involved in tracking, analyzing, and forecasting cash flow, accounting software can help businesses of all sizes stay on top of their finances.

Real-Time Financial Insights

One of the main ways accounting software improves cash flow management is by providing real-time financial insights. Unlike traditional methods that rely on periodic reports, accounting software allows you to access up-to-the-minute information about your business’s financial health.

With accurate, real-time data at your fingertips, you can:

- Track incoming and outgoing funds instantly.

- Identify cash flow gaps early before they become a problem.

- Adjust spending and collections strategies in response to changing cash flow dynamics.

Having access to these insights helps you make informed decisions, avoid cash flow crises, and keep operations running smoothly.

Simplified Invoicing and Payments

How often do you find yourself chasing down clients or suppliers for payments? With accounting software, you can streamline invoicing and payment collection. Most accounting tools allow you to:

- Create and send invoices automatically.

- Set up payment reminders for overdue invoices.

- Integrate with payment systems, allowing for easier, faster transactions.

This not only saves time but also reduces the chances of missed or delayed payments, improving cash flow consistency.

Expense Management and Reduction

Tracking expenses manually can be time-consuming and prone to error. Accounting software simplifies this process by automatically categorizing and tracking your expenses. By doing so, it helps you:

- Identify unnecessary expenses and areas where you can cut costs.

- Stay on top of recurring bills and subscriptions, reducing the risk of missing payments.

- Generate reports that give you a clearer view of where your money is going.

By tightening up your expenses, you free up more capital to reinvest in your business or pay down debts.

Cash Flow Forecasting

Forecasting future cash flow is one of the most valuable features of accounting software. With built-in forecasting tools, you can:

- Predict future cash flow trends based on past data.

- Prepare for seasonal fluctuations or market changes.

- Plan for growth by anticipating potential cash shortages or surpluses.

Having a clear understanding of your future cash position enables you to make proactive decisions, such as securing a loan before a dry period or delaying non-essential purchases during a cash surplus.

Increased Financial Control and Compliance

When you have control over your cash flow, it’s easier to ensure that your business is financially stable and compliant with regulations. Accounting software:

- Helps you stay compliant with tax laws by tracking income and expenses.

- Makes it easier to prepare tax reports and submit accurate returns.

- Provides a transparent record of all transactions for auditing purposes.

Having organized, reliable financial records means fewer headaches when tax season rolls around and ensures your business stays on track.

Key Benefits of Accounting Software for Cash Flow Management

- Improved cash flow visibility: Monitor your cash position at any time.

- Faster payments: Automate invoicing and collections for quicker payments.

- Cost savings: Identify areas to reduce expenses and reinvest savings.

- Better forecasting: Plan ahead with accurate cash flow projections.

- Tax and compliance efficiency: Stay compliant and simplify tax filing.

A Quick Look: Accounting Software Comparison Table

| Feature | QuickBooks | Xero | FreshBooks |

|---|---|---|---|

| Invoicing | Automatic invoicing | Customizable templates | Recurring invoices |

| Cash Flow Forecasting | Basic forecasting | Advanced forecasting | Basic forecasting |

| Expense Tracking | Automatic categorization | Unlimited categories | Expense reports |

| Payment Integration | Bank syncing, PayPal | Bank syncing, Stripe | PayPal, credit cards |

| Mobile Access | Yes | Yes | Yes |

| Tax Compliance | Automated tax filing | Easy tax reports | Sales tax reports |

Pros and Cons of Using Accounting Software for Cash Flow

Pros:

- Streamlines financial management.

- Saves time with automation.

- Improves cash flow visibility and control.

- Allows for better financial forecasting.

- Integrates with payment systems for easier transactions.

Cons:

- Initial setup can be time-consuming.

- May require a learning curve, especially for complex features.

- Some tools may be expensive for small businesses.

FAQs About Accounting Software and Cash Flow

1. How can accounting software improve cash flow forecasting?

Accounting software uses historical data to predict future trends, helping you prepare for potential cash shortages or surpluses.

2. Can accounting software help me reduce late payments?

Yes, it can automate invoicing and payment reminders, ensuring you collect payments faster and more consistently.

3. Does accounting software track my expenses automatically?

Most accounting software automatically categorizes and tracks your expenses, saving you time and reducing errors.

4. Is it easy to integrate accounting software with payment systems?

Yes, most accounting software options integrate with payment systems like PayPal, Stripe, and bank accounts for seamless transactions.

5. Can accounting software help with tax compliance?

Yes, it can help you track income and expenses, generate tax reports, and ensure your financial records are ready for tax season.

6. How accurate is cash flow forecasting with accounting software?

Cash flow forecasting is highly accurate when based on real-time data, past performance, and smart algorithms, though it’s important to keep your records up to date.

7. Is accounting software suitable for small businesses?

Yes, accounting software is ideal for small businesses looking to streamline financial management and improve cash flow control.

Conclusion

So, how does accounting software impact cash flow? It enhances cash flow visibility, simplifies invoicing and payments, improves forecasting, and helps control expenses. In short, accounting software provides you with the tools you need to stay ahead of cash flow issues, manage your business finances more efficiently, and set your company up for long-term success. Investing in the right accounting software can help you avoid cash flow surprises and make more informed financial decisions.

Also Read: Will AI Become Conscious? What Experts Say