5 Ways Kofax Boosts Productivity in Financial Operations

In today’s fast-paced digital economy, financial departments are under more pressure than ever. They need to process high volumes of data quickly, maintain accuracy, ensure compliance, and still find time for strategic planning. It’s a tall order, and traditional manual processes just can’t keep up. This powerhouse automation platform is designed to revolutionize how financial operations function. From speeding up invoice processing to reducing compliance risks, Kofax offers a full suite of tools that streamline workflows and elevate productivity.

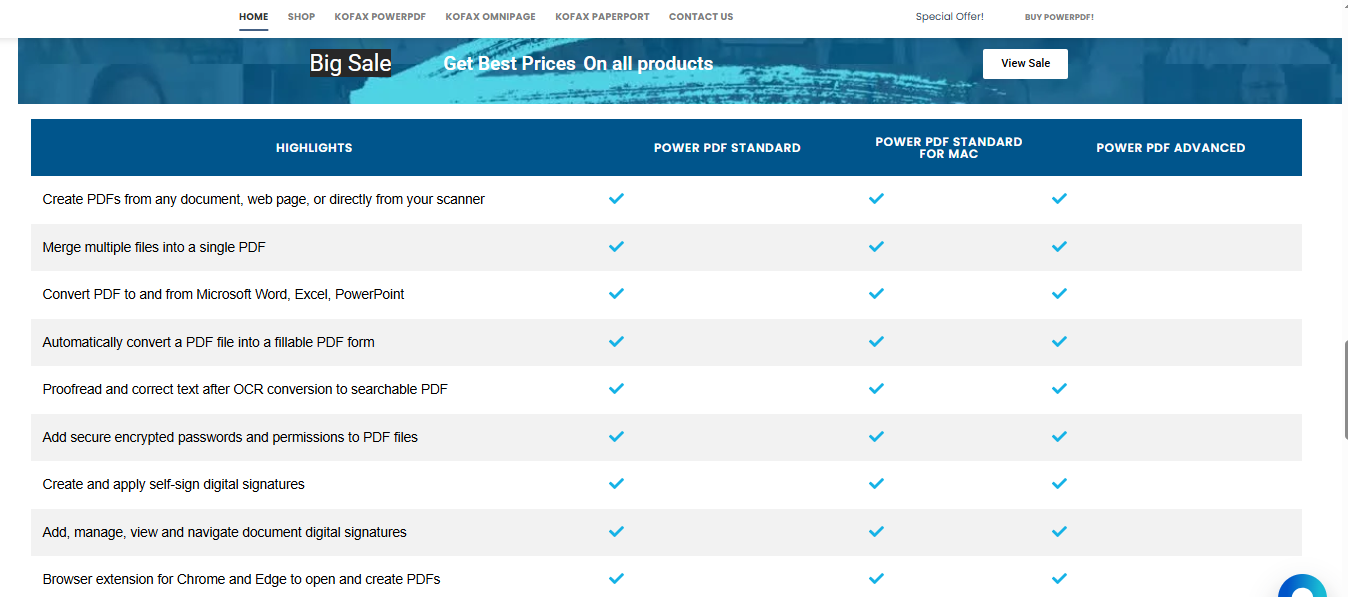

How Kofax Power PDF Helps in Financial Operations

1. Streamlining Invoice Processing

Managing invoices manually is one of the most tedious and error-prone tasks in finance. Worse yet, manual data entry not only consumes time but also increases the risk of errors that could cost the business money or even its reputation. Approvals get bottlenecked, duplicate payments slip through, and late payment penalties pile up. Finance teams find themselves firefighting rather than focusing on value-added tasks.

2. Kofax Automation to the Rescue

Kofax turns this messy situation into a streamlined digital process. Its invoice automation capabilities capture invoices from any format, email, scanned paper, or PDF, and automatically extract key data like invoice numbers, dates, vendor names, and amounts. The system uses machine learning and OCR (optical character recognition) to get smarter with each invoice it processes. It validates information against purchase orders, flags inconsistencies, and routes invoices for approval without human intervention.

The real kicker? Everything happens in near real-time. Finance teams can now track the status of any invoice instantly. No more chasing down approvers or manually matching POs. Kofax removes friction from the entire invoice lifecycle.

3. Real-time Benefits in Accounts Payable

The outcome is crystal clear. With Kofax, companies report processing invoices up to 80% faster and reduce invoice-related errors by over 90%. That’s not just a small improvement; that’s a game-changer. AP departments become proactive instead of reactive. They can take advantage of early payment discounts and build stronger vendor relationships due to timely payments. And because the process is digital and traceable, it’s also easier to audit and comply with internal policies or external regulations. That’s productivity, compliance, and cost savings rolled into one.

4. Enhancing Data Accuracy and Compliance

Finance teams deal with enormous amounts of sensitive data daily account balances, tax information, vendor details, and more. When data is handled manually, errors are inevitable. A single typo or misfiled document can result in reporting inaccuracies, compliance violations, and even financial losses. Plus, maintaining compliance with ever-evolving regulations like SOX, GDPR, or local tax codes adds another layer of complexity.

6. Kofax’s Smart Capture and Validation Tools

Kofax dramatically reduces these risks with its intelligent data capture and validation tools. The software not only extracts information but also validates it in real-time against internal records or external databases. For instance, if an invoice doesn’t match a purchase order, it’s flagged immediately for review. If a vendor’s bank details change, the system can trigger an alert to prevent fraudulent transactions.

Kofax also maintains an audit trail for every transaction, making it easy to track who did what and when. This transparency is gold when it comes to compliance and audits. The platform ensures that financial documents meet regulatory requirements and internal policy checks without the need for manual monitoring.

7. Mitigating Risks and Ensuring Regulatory Compliance

With automated controls in place, the chances of compliance breaches drop significantly. Whether it’s tracking tax calculations, flagging suspicious transactions, or ensuring the accuracy of financial reports, Kofax has it covered. Finance leaders sleep easier knowing their systems are working round-the-clock to catch mistakes before they happen.

Beyond compliance, the improved data quality empowers teams to make better decisions. Clean, validated data means reports are more reliable and insights are more actionable. And when regulators come knocking, audit readiness is no longer a fire drill; it’s business as usual.

8. Accelerating Financial Decision-Making

In the finance world, time is everything. Delayed decisions can cost millions in missed opportunities or undetected risks. Traditional reporting methods, usually involving spreadsheets and monthly reports, are slow, outdated, and prone to inaccuracies. By the time data is compiled and analyzed, the moment for action may have already passed. This lag not only hampers agility but also undermines confidence in financial leadership.

9. Improving Forecasts and Strategic Planning

With a clearer picture of the financial landscape, organizations can move beyond guesswork and into precision planning. Budgeting becomes more dynamic. Scenario modeling becomes more accurate. Strategic investments are backed by data rather than hunches. In essence, Kofax turns finance into a proactive, strategic driver of business success, not just a back-office function.

The ripple effect is huge. Teams become more aligned, resources are allocated more efficiently, and performance improves across the board. When data speaks, leadership listens, and Kofax makes sure the message is loud and clear.

10. Optimizing Workflow Automation Across Departments

One of the biggest obstacles to financial productivity isn’t workload it’s siloes. Finance teams often operate in isolation from procurement, HR, IT, and other departments, leading to duplicated efforts, miscommunication, and delays. For example, if procurement orders something without syncing with finance, budget overruns are almost guaranteed. If HR expenses aren’t reconciled promptly, it affects payroll accuracy.

11. Kofax’s Unified Platform for Cross-Functional Workflows

Kofax addresses this disconnect by offering a unified automation platform that integrates workflows across departments. It’s low-code and no-code design tools let users map out end-to-end processes without heavy IT involvement. Whether it’s automating vendor onboarding, syncing procurement with AP, or streamlining employee expense approvals, Kofax brings everyone onto the same page.

Each step in a process is automatically routed to the right person or system, complete with alerts, SLAs, and digital approvals. Integration with ERP systems like SAP, Oracle, or NetSuite ensures that data flows seamlessly without manual re-entry. This connectivity not only boosts accuracy but also accelerates the entire process.

12. Creating a More Agile Financial Organization

With fewer bottlenecks and better collaboration, financial operations become more agile. Teams spend less time chasing approvals or fixing errors and more time on analysis and planning. Cross-functional transparency improves, and the entire business benefits from faster, more cohesive execution.

And because Kofax supports continuous improvement, workflows can be optimized on the fly. Need to add a new approval layer? Just drag and drop. Need to reroute invoices based on spend thresholds? It’s done in minutes. This agility ensures finance can adapt quickly to changing business needs without missing a beat.

13. Reducing Operational Costs Significantly

Manual financial processes don’t just waste time; they drain money. Labor costs skyrocket when teams are buried in paperwork. Mistakes like overpayments, missed discounts, or fraud slip through the cracks. Compliance failures can lead to hefty fines. And let’s not forget the opportunity costs of tying up skilled professionals with repetitive tasks instead of strategic work.

How Kofax Drives Down Overheads

By automating routine tasks, Kofax slashes the time and effort needed to manage financial operations. Invoice processing, document management, data validation, and reporting are all handled faster and more accurately by bots and smart workflows. The result is fewer errors, faster turnaround, and massive cost savings.

Take document handling, for example. What once required scanning, filing, and manual entry can now be done digitally in seconds. Or consider vendor payments. With Kofax, you can avoid late fees, earn early-payment discounts, and prevent duplicate payments, all of which directly impact the bottom line.

ROI Success Stories in Finance with Kofax

Many organizations report achieving ROI on their Kofax investment within the first year. Case studies show companies reducing invoice processing costs by up to 70%, slashing cycle times by days or even weeks, and significantly improving working capital management.

The financial gains aren’t limited to cost cuts either. With teams freed from busy work, there’s more capacity to focus on growth, innovation, and service delivery. In this way, Kofax doesn’t just save money, it creates value.

Conclusion

Kofax isn’t just another tool in your financial tech stack; it’s a complete transformation engine. In a world where agility, accuracy, and efficiency define success, Kofax equips financial teams with the power to thrive. Whether it’s accelerating invoice cycles, improving data integrity, enabling faster decisions, breaking down departmental siloes, or significantly reducing operational costs, Kofax consistently delivers real, measurable results.

What makes Kofax stand out is its seamless integration with existing systems and its ability to scale with your business. You don’t need to overhaul your entire tech infrastructure to enjoy the benefits. Plus, with user-friendly automation tools, even non-technical team members can create and optimize workflows without IT bottlenecks.

Financial operations are no longer just about balancing books; they’re about driving business value. Kofax helps finance teams move beyond routine tasks to become proactive strategic contributors. With automation, analytics, and seamless workflows at their fingertips, they can focus on what matters: growth, innovation, and impact.

If your finance department still relies on spreadsheets, emails, and manual approvals, it’s time for a serious upgrade. Kofax doesn’t just boost productivity, it redefines what’s possible.

FAQs

1. What is Kofax used for in finance?

Kofax is used in finance to automate and streamline processes like invoice processing, accounts payable, data entry, compliance tracking, and financial reporting. It helps finance teams reduce manual work, minimize errors, and speed up operations with smart automation and real-time analytics.

2. Can Kofax integrate with ERP systems?

Yes, Kofax integrates seamlessly with major ERP systems like SAP, Oracle, Microsoft Dynamics, NetSuite, and others. These integrations ensure smooth data flow between systems and reduce the need for duplicate data entry or manual reconciliation.

3. How does Kofax improve compliance?

Kofax enhances compliance by automating validations, maintaining audit trails, and ensuring data accuracy. Its intelligent capture technology flags discrepancies enforces business rules, and supports regulatory requirements such as SOX, GDPR, and tax compliance standards.

4. What kind of ROI can financial teams expect?

Many organizations report an ROI within the first year of using Kofax. Savings come from reduced processing times, fewer errors, early payment discounts, and lower overhead costs. In some cases, companies have cut invoice processing costs by up to 70%.

5. Is Kofax suitable for small finance teams too?

Absolutely. Kofax offers scalable solutions that work just as well for small finance teams as they do for large enterprises. Its modular design and cloud capabilities make it accessible and cost-effective, even for organizations with limited IT resources.