What Blockchain in Accounting Means for CFOs and Finance Teams – 7 Ways It’s Revolutionizing the Finance Function

Blockchain, the same technology powering cryptocurrencies like Bitcoin and Ethereum, is quickly finding a home in the world of accounting. But we’re not talking about digital coins here. For CFOs and finance teams, blockchain in accounting offers a secure, transparent, and real-time ledger system that could replace or at least enhance traditional bookkeeping methods.

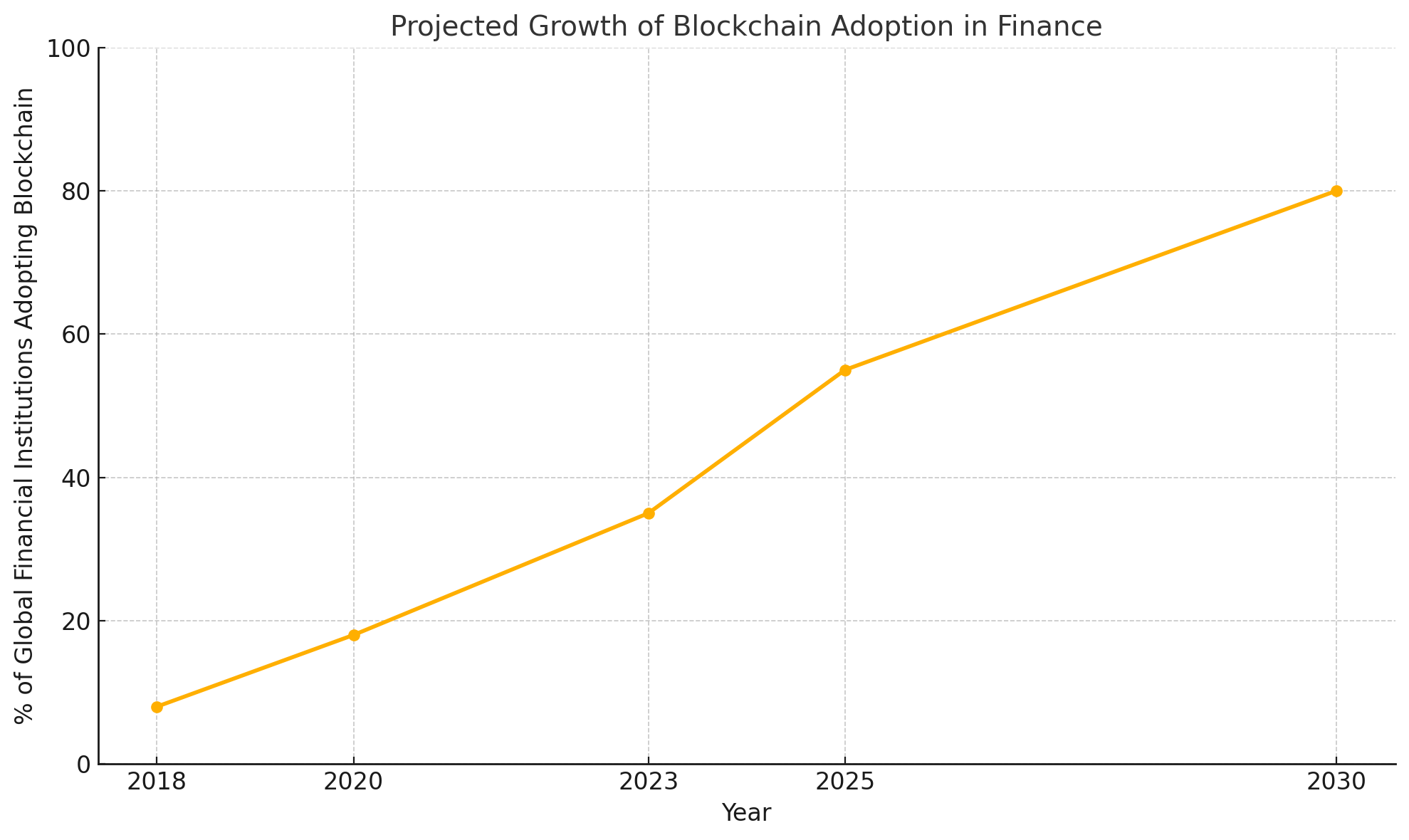

By 2026, Gartner estimates that blockchain will generate $360 billion in business value, rising to over $3.1 trillion by 2030.

How Blockchain Works in Finance

Blockchain is essentially a decentralized digital ledger that records transactions across many computers. Each entry is time-stamped, immutable, and visible to all authorized participants.

For accountants, this means:

- No single point of failure

- Tamper-proof data entries

- Efficient, real-time data syncing across departments and systems

This is especially useful when managing thousands of transactions daily, across multiple departments or even countries.

Blockchain Adoption Growth (2018–2030)

Benefits of Blockchain for CFOs and Finance Professionals

Let’s dig into the real-world benefits of this technology for finance teams:

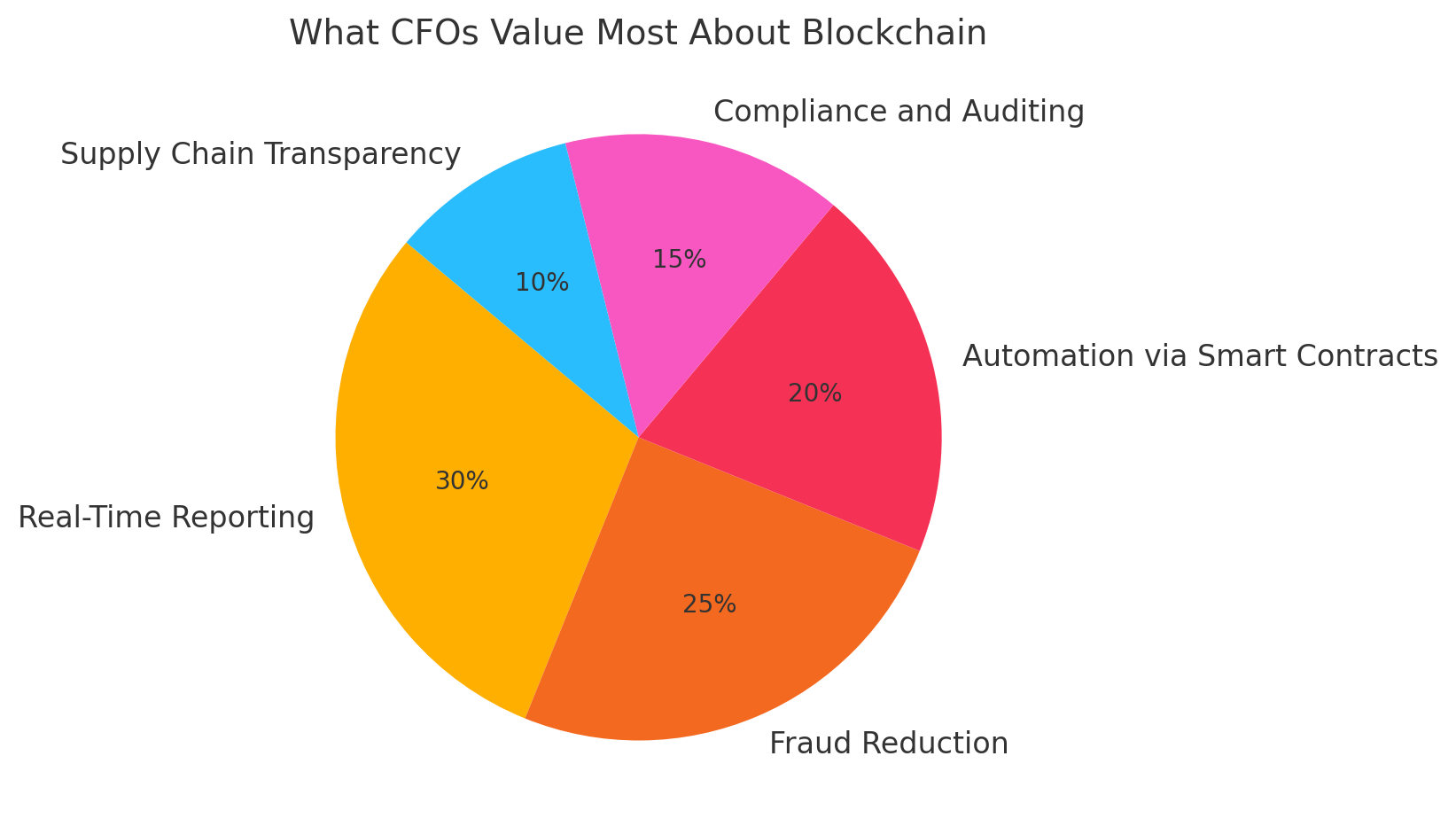

1. Real-Time Financial Reporting

Traditionally, finance teams compile data from multiple sources and perform reconciliations before preparing reports. Blockchain simplifies this process.

With blockchain:

- Transactions are recorded in real-time.

- Reports can be generated automatically.

- CFOs can make decisions based on live financial snapshots.

📊 Example Table: Traditional vs Blockchain Reporting

| Feature | Traditional Systems | Blockchain-Powered |

|---|---|---|

| Data Entry | Manual/Input-based | Automated |

| Frequency | Monthly/Quarterly | Real-Time |

| Accuracy | Prone to errors | Tamper-proof |

| Cost | High audit fees | Reduced overhead |

2. Enhanced Audit and Compliance Capabilities

Blockchain allows auditors to access real-time financial data via secure smart contracts. No more manual document tracing or endless paper trails.

✅ Audits become:

- Faster

- More accurate

- Transparent and traceable

According to Deloitte, blockchain can reduce audit times by 50%, thanks to continuous and automated verification.

3. Reduction in Fraud Risk and Data Tampering

Because every transaction is time-stamped and immutable, it becomes nearly impossible for bad actors to manipulate financial records.

🛡️ Use cases:

- Preventing unauthorized journal entries

- Authenticating vendor payments

- Monitoring suspicious employee reimbursements

4. Smarter Contract Management and Automation

Smart contracts automate financial agreements, releasing payments when conditions are met.

💡 Example: A vendor is paid automatically once goods are received and verified through IoT and blockchain.

This reduces:

- Delays

- Manual intervention

- Payment disputes

5. Supply Chain Financial Transparency

Blockchain enables end-to-end tracking of goods and financial flows.

🧾 Benefits:

- Cross-border payment transparency

- GST/VAT management in multi-region supply chains

- Real-time customs clearance tracking

6. Improved Intercompany Reconciliation

Large enterprises often struggle to reconcile internal transactions across entities.

With blockchain, each entity has access to a single version of the truth, automating reconciliation and minimizing discrepancies.

📉 Impact: IBM reduced intercompany reconciliation errors by 70% using blockchain-based ledgers.

7. Decentralized Finance (DeFi) Integration

Blockchain opens doors to DeFi solutions, such as:

- Tokenized assets

- On-chain lending

- Interest-bearing wallets

For CFOs, this means exploring new liquidity options beyond banks, though with careful risk management.

Key Benefits of Blockchain in Accounting (Per CFO Survey)

Blockchain in ERP and Accounting Software

Popular ERP platforms like SAP, Oracle, and Microsoft Dynamics are already integrating blockchain modules.

🔧 Features Include:

- Blockchain-as-a-Service (BaaS)

- Secure vendor onboarding

- Anti-fraud invoice validation

- Real-time multi-ledger synchronization

Challenges and Risks of Blockchain in Finance

Like any emerging tech, blockchain isn’t without risks:

| Risk | Description |

|---|---|

| Scalability | Limited throughput in public chains |

| Regulation | Varying global standards |

| Integration | Requires system overhauls |

| Training | Finance staff may lack blockchain literacy |

That said, these are not dealbreakers—but signals that change management is key.

Blockchain vs Traditional Accounting Features

| Feature | Traditional Accounting | Blockchain Accounting |

|---|

| Data Tampering Risk | High | Virtually None |

| Reporting Speed | Slow | Real-Time |

| Audit Trail | Manual | Automatic |

| Transparency | Low | High |

| Cost | Higher (due to labor) | Lower (long-term) |

Future of Blockchain in Corporate Finance

Expect to see:

- CFOs hiring blockchain-savvy analysts

- Smart compliance systems

- Crypto-asset accounting frameworks

- Integration with AI for predictive finance

💥 By 2030, blockchain accounting may be as standard as spreadsheets today.

Case Studies: Blockchain Adoption by Finance Leaders

1. PwC & Blockchain Audit

PwC launched blockchain audit tools that let clients track and validate crypto holdings in real-time.

2. Walmart & Supply Chain

Walmart implemented blockchain for food traceability, cutting trace time from 7 days to 2.2 seconds.

3. Maersk & TradeLens

Maersk reduced invoice verification time by 40% using blockchain-based trade finance.

FAQs

1. How can CFOs start implementing blockchain in their departments?

Begin with small, non-core processes like invoice management or smart contracts before full-scale rollouts.

2. Is blockchain accounting legal?

Yes, but local regulations may vary. The IRS, FASB, and IASB are all working on crypto-specific guidelines.

3. What skills do finance teams need to adopt blockchain?

Basics of distributed ledger tech, understanding smart contracts, and cross-functional collaboration with IT.

4. Is blockchain suitable for SMEs or only large enterprises?

BaaS (Blockchain-as-a-Service) platforms make it affordable and scalable for SMEs, too.

5. What is the ROI of blockchain in finance?

While initial costs are high, audit, compliance, and error-reduction savings can exceed 30–50% annually.

6. Can blockchain be hacked?

Not easily. It’s virtually tamper-proof. However, smart contracts can be vulnerable if poorly coded.